CNF: Meaning, vs FOB/CIF, Key Applications

In the complex system of international trade, trade terms are crucial tools for clarifying the division of responsibilities, costs, and risks between buyers and sellers. CNF (Cost and Freight) is one of the significant terms, which clearly defines the rights and obligations of both parties in sea and inland waterway transport scenarios.

I. Explanation of CNF Term

Under the CNF term, the seller is responsible for transporting the goods to the buyer's designated port of destination and bears the freight incurred before the goods arrive at the port of destination. However, once the goods pass the ship's rail at the port of shipment, the risk is transferred to the buyer, and subsequent costs are also borne by the buyer. For example, when a Chinese supplier conducts a transaction with a British buyer under CNF terms, the Chinese supplier is responsible for the freight to transport the goods to the British port, but the British buyer bears all risks after the goods are loaded on board.

II. Division of Responsibilities between Buyer and Seller under CNF

Under the CNF term, the seller is responsible for transporting the goods to the buyer's designated port of destination and bears the freight incurred before the goods arrive at the port of destination. However, once the goods pass the ship's rail at the port of shipment, the risk is transferred to the buyer, and subsequent costs are also borne by the buyer. For example, when a Chinese supplier conducts a transaction with a British buyer under CNF terms, the Chinese supplier is responsible for the freight to transport the goods to the British port, but the British buyer bears all risks after the goods are loaded on board.

(I) Seller's Responsibilities

1. Be responsible for the production, packaging, and export customs clearance procedures of the goods to ensure that the goods meet export standards and can clear customs smoothly.

2. Transport the goods from the place of origin to the port of shipment and bear the costs during this process.

3. Pay the freight from the port of shipment to the port of destination to ensure that the goods can arrive at the designated port on time.

4. Not bear the insurance costs during transportation, as purchasing insurance is not the seller's obligation.

1. Be responsible for the production, packaging, and export customs clearance procedures of the goods to ensure that the goods meet export standards and can clear customs smoothly.

2. Transport the goods from the place of origin to the port of shipment and bear the costs during this process.

3. Pay the freight from the port of shipment to the port of destination to ensure that the goods can arrive at the designated port on time.

4. Not bear the insurance costs during transportation, as purchasing insurance is not the seller's obligation.

(II) Buyer's Responsibilities

1. Bear the risks after the goods are loaded on board. If the goods are damaged or lost during transportation, the losses are the buyer's responsibility.

2. Be responsible for the unloading costs at the port of destination, import customs clearance procedures, and inland transportation costs.

3. Decide whether to purchase cargo transportation insurance according to their own needs to reduce transportation risks.

1. Bear the risks after the goods are loaded on board. If the goods are damaged or lost during transportation, the losses are the buyer's responsibility.

2. Be responsible for the unloading costs at the port of destination, import customs clearance procedures, and inland transportation costs.

3. Decide whether to purchase cargo transportation insurance according to their own needs to reduce transportation risks.

III. Differences between CNF, FOB, and CIF

(I) FOB (Free on Board)

Under the FOB term, the seller is responsible for loading the goods on board at the port of shipment and bears all costs and risks before the goods are loaded on board. The buyer, on the other hand, bears subsequent costs and risks after the goods pass the ship's rail. Different from CNF, the seller under FOB does not need to bear the freight to transport the goods to the port of destination.

Under the FOB term, the seller is responsible for loading the goods on board at the port of shipment and bears all costs and risks before the goods are loaded on board. The buyer, on the other hand, bears subsequent costs and risks after the goods pass the ship's rail. Different from CNF, the seller under FOB does not need to bear the freight to transport the goods to the port of destination.

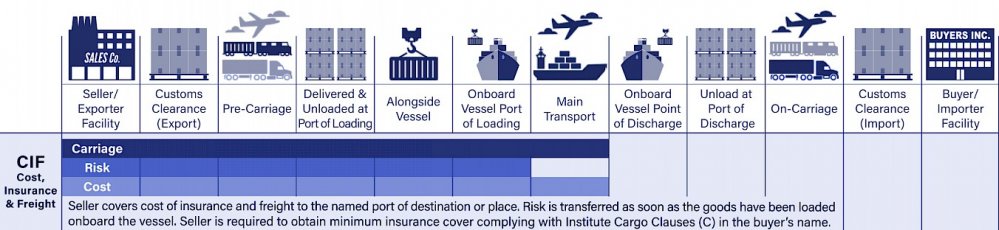

(II) CIF (Cost, Insurance and Freight)

The comparison of the differences among the three terms is shown in the following:

CNF (Cost and Freight):

- The seller is responsible for transporting the goods to the port of destination and bearing the freight.

- The buyer bears the risks after the goods are loaded on board.

- The buyer decides whether to purchase insurance.

- The risk transfer point is when the goods are loaded on board at the port of shipment.

- It is mainly applicable to sea and inland waterway transport.

FOB (Free on Board):

- The seller is responsible for transporting the goods to the port of shipment and bearing the loading costs.

- The buyer bears the costs and risks after loading.

- The buyer decides whether to purchase insurance.

- The risk transfer point is after the goods are loaded on board at the port of shipment.

- It is mainly applicable to sea and inland waterway transport.

CIF (Cost, Insurance and Freight):

- The seller is responsible for bearing the freight and insurance costs to the port of destination.

- The buyer bears the unloading and other transportation costs at the port of destination.

- The seller must purchase minimum insurance.

- The risk transfer point is when the goods are loaded on board at the port of shipment.

- It is mainly applicable to sea and inland waterway transport.

The comparison of the differences among the three terms is shown in the following:

CNF (Cost and Freight):

- The seller is responsible for transporting the goods to the port of destination and bearing the freight.

- The buyer bears the risks after the goods are loaded on board.

- The buyer decides whether to purchase insurance.

- The risk transfer point is when the goods are loaded on board at the port of shipment.

- It is mainly applicable to sea and inland waterway transport.

FOB (Free on Board):

- The seller is responsible for transporting the goods to the port of shipment and bearing the loading costs.

- The buyer bears the costs and risks after loading.

- The buyer decides whether to purchase insurance.

- The risk transfer point is after the goods are loaded on board at the port of shipment.

- It is mainly applicable to sea and inland waterway transport.

CIF (Cost, Insurance and Freight):

- The seller is responsible for bearing the freight and insurance costs to the port of destination.

- The buyer bears the unloading and other transportation costs at the port of destination.

- The seller must purchase minimum insurance.

- The risk transfer point is when the goods are loaded on board at the port of shipment.

- It is mainly applicable to sea and inland waterway transport.

IV. Advantages and Disadvantages of CNF Term

(I) Advantages

1. For the Seller: Can control the transportation route of the goods to ensure that the goods arrive at the port of destination on time; does not need to bear insurance costs, simplifying cost accounting to a certain extent.

2. For the Buyer: Does not need to worry about the transportation arrangements at the port of shipment, only needs to focus on subsequent costs at the port of destination, and the cost composition is relatively clear.

1. For the Seller: Can control the transportation route of the goods to ensure that the goods arrive at the port of destination on time; does not need to bear insurance costs, simplifying cost accounting to a certain extent.

2. For the Buyer: Does not need to worry about the transportation arrangements at the port of shipment, only needs to focus on subsequent costs at the port of destination, and the cost composition is relatively clear.

(II) Disadvantages

1. For the Seller: Needs to bear all costs before the goods arrive at the port of destination, and it is difficult to control possible additional costs during transportation.

2. For the Buyer: Needs to bear risks after the goods are loaded on board. If the goods are damaged or lost, it needs to handle insurance claims independently, with relatively high risks.

1. For the Seller: Needs to bear all costs before the goods arrive at the port of destination, and it is difficult to control possible additional costs during transportation.

2. For the Buyer: Needs to bear risks after the goods are loaded on board. If the goods are damaged or lost, it needs to handle insurance claims independently, with relatively high risks.

V. Key Points for Using CNF Term

(I) Clear Contract Terms

During trade negotiations and contract signing, it is necessary to clearly specify the use of the CNF term and define the port of destination in detail to avoid ambiguity in transportation responsibilities and costs.

During trade negotiations and contract signing, it is necessary to clearly specify the use of the CNF term and define the port of destination in detail to avoid ambiguity in transportation responsibilities and costs.

(II) Customs Clearance Documents

The seller should prepare the necessary documents for export customs clearance to ensure the smooth loading of the goods. The buyer needs to understand the customs clearance process and requirements at the port of destination to handle relevant affairs in a timely manner.

The seller should prepare the necessary documents for export customs clearance to ensure the smooth loading of the goods. The buyer needs to understand the customs clearance process and requirements at the port of destination to handle relevant affairs in a timely manner.

(III) Insurance Arrangements

Although the CNF term does not obligate the seller to purchase insurance, the buyer should decide whether to purchase insurance according to the value and transportation risks of the goods to reduce potential losses.

Although the CNF term does not obligate the seller to purchase insurance, the buyer should decide whether to purchase insurance according to the value and transportation risks of the goods to reduce potential losses.

(IV) Risk Transfer Notification

After the goods are loaded on board and pass the ship's rail, the seller should promptly notify the buyer that the risk has been transferred, facilitating the buyer to purchase insurance or take risk prevention measures in a timely manner.

After the goods are loaded on board and pass the ship's rail, the seller should promptly notify the buyer that the risk has been transferred, facilitating the buyer to purchase insurance or take risk prevention measures in a timely manner.

VI. Application Scenarios of CNF Term

CNF is mainly applicable to sea and inland waterway transport and is widely used in the following scenarios:

1. Long-Distance Transportation: Suitable for long-distance cargo transportation in international trade, allowing for clear cost and responsibility sharing before shipment.

2. High-Value Goods or Bulk Orders: When the buyer has good logistics management and risk-bearing capabilities, the CNF term is more suitable for transporting high-value goods.

CNF is mainly applicable to sea and inland waterway transport and is widely used in the following scenarios:

1. Long-Distance Transportation: Suitable for long-distance cargo transportation in international trade, allowing for clear cost and responsibility sharing before shipment.

2. High-Value Goods or Bulk Orders: When the buyer has good logistics management and risk-bearing capabilities, the CNF term is more suitable for transporting high-value goods.

VII. Avoiding Common Mistakes in Using CNF

1. Clearly Define the Risk Transfer Point: Clearly define the specific time and conditions for risk transfer in the contract to reduce misunderstandings between both parties.

2. Estimate Destination Port Costs: The buyer should accurately assess the unloading, customs clearance, and other costs at the port of destination in advance to calculate the total cost reasonably.

3. Consider Additional Insurance: The buyer can choose to purchase additional insurance according to the characteristics and value of the goods to further reduce transportation risks.

In international trade, choosing the right trade term is of utmost importance. The CNF term is suitable for buyers with high requirements for cost control and strong risk management capabilities. Before signing a contract, both parties must fully understand the meaning of the trade term and the risk transfer arrangements, which is the key to protecting the interests of both parties.

1. Clearly Define the Risk Transfer Point: Clearly define the specific time and conditions for risk transfer in the contract to reduce misunderstandings between both parties.

2. Estimate Destination Port Costs: The buyer should accurately assess the unloading, customs clearance, and other costs at the port of destination in advance to calculate the total cost reasonably.

3. Consider Additional Insurance: The buyer can choose to purchase additional insurance according to the characteristics and value of the goods to further reduce transportation risks.

In international trade, choosing the right trade term is of utmost importance. The CNF term is suitable for buyers with high requirements for cost control and strong risk management capabilities. Before signing a contract, both parties must fully understand the meaning of the trade term and the risk transfer arrangements, which is the key to protecting the interests of both parties.

English

English 简体中文

简体中文 繁體中文

繁體中文 Afrikaans

Afrikaans አማርኛ

አማርኛ Español

Español العربية

العربية Français

Français Dansk

Dansk Български

Български Беларуская мова

Беларуская мова বাংলা

বাংলা Português

Português Русский

Русский Afsoomaali

Afsoomaali فارسی

فارسی Türkçe

Türkçe كوردی

كوردی Deutsch

Deutsch 日本語

日本語 ไทย

ไทย Tiếng Việt

Tiếng Việt Italiano

Italiano עִבְרִית

עִבְרִית 한국어

한국어 Română

Română Nederlands

Nederlands Bahasa Indonesia

Bahasa Indonesia Shona

Shona